How Net Debt Is Calculated and Why It Matters to a Company

Its goal is to speed up and streamline the bankruptcy process for businesses that qualify, currently those with debts of $7.5 million or less. Similarly, unless the court rules otherwise, federal, state, and local tax returns must continue to be filed when due, or with extensions sought by the DIP as needed. The DIP must also maintain adequate insurance on the assets—and be able to document that coverage.

- Consider a mom-and-pop restaurant that was forced into bankruptcy during a recession.

- The restaurant may still have talented staff, a good reputation, and loyal customers.

- Let’s look at a few examples from different industries to contextualize the debt ratio.

- There is nothing wrong with being a debtor — it is very common for people and companies to borrow money from other companies.

- Thus, an entity could be a debtor in relation to specific payables, while being flush with cash in all other respects.

Depending on the type of undertaking, debt can be referred to in different terms. For example, if a debt is obtained from a financial institution (e.g., bank), the debtor is usually referred to as a borrower. If the debt is issued in the form of financial securities (e.g., bonds), the debtor is referred to as an issuer. Offer pros and cons are determined by our editorial team, based on independent research. The banks, lenders, and credit card companies are not responsible for any content posted on this site and do not endorse or guarantee any reviews. You can also consolidate several debts into one, which may make sense if the new loan carries a lower interest rate.

What do creditors and debtors mean for cashflow?

Clear Books is an award-winning online accounting software for small businesses. Thousands of business owners, contractors, freelancers and sole traders across the UK use our easy-to-use online accounting software to manage their business finances. All users benefit from the outstanding free telephone and email support. Perhaps 53.6% isn’t so bad after all when you consider that the industry average was about 75%.

It was created by the Bankruptcy Abuse Prevention and Consumer Protection Act (BAPCPA) in 2005. Small businesses that qualify can use either it or the more recent Subchapter V. So, there you have https://simple-accounting.org/ it – a guide to everything you need to know about creditors and debtors. Being a creditor for another business can be considered an asset, demonstrating financial strength to your business.

- A creditor is a person or an organization that provides money to another party immediately in exchange for receiving money at some point in the future with or without additional interest.

- Chapter 11 is a type of bankruptcy most often filed for by businesses, in particular corporations and partnerships.

- A customer invoice counts as income at the point that it’s raised, even before it’s been paid, so you should still show them on your balance sheet.

- If they choose what’s known as the standard repayment plan, they will be required to make fixed monthly payments for 10 years, at which point their debt will be completely paid off.

- If the borrower fails to make payments, the lender can foreclose and take the home.

- A company might be in financial distress if it has too much debt, but also the maturity of the debt is important to monitor.

A debt ratio of 30% may be too high for an industry with volatile cash flows, in which most businesses take on little debt. A company with a high debt ratio relative to its peers would probably find it expensive to borrow and could find itself in a crunch if circumstances change. Conversely, a debt level of 40% may be easily manageable for a company in a sector such as utilities, where cash flows are stable and higher debt ratios are the norm. The term debt ratio refers to a financial ratio that measures the extent of a company’s leverage.

Meaning of debt in English

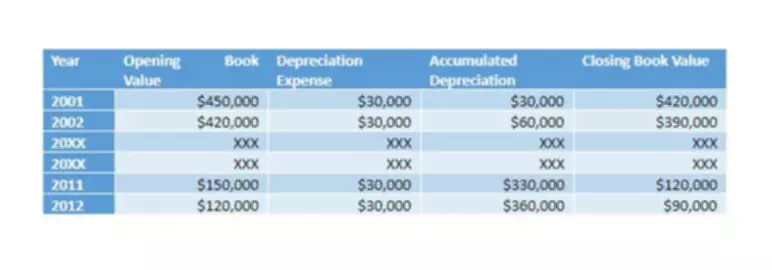

Since equity is equal to assets minus liabilities, the company’s equity would be $800,000. Its debt-to-equity ratio would therefore be $1.2 million divided by $800,000, or 1.5. The debt ratio is a simple ratio that is easy to compute and comprehend. It gives a fast overview of how much debt a firm has in comparison to all of its assets. Because public companies must report these figures as part of their periodic external reporting, the information is often readily available.

Examples of debt include amounts owed on credit cards, car loans, and mortgages. For example, consumers should pay attention to their credit utilization ratio, also known as a debt-to-limit ratio. That’s the amount of debt they currently owe as a percentage of the total amount of credit they have available to them. For example, if https://online-accounting.net/ someone has two credit cards with a combined credit limit of $10,000, and they currently owe $5,000 on those cards, their credit utilization ratio is 50%. You may hear a borrower referred to a debtor, since they are someone who takes on debt. A lender — the entity that lends money to a person or a business — is the creditor.

Buying a Business

The financial health of a firm may not be accurately represented by comparing debt ratios across industries. Bear in mind how certain industries may necessitate higher debt ratios due to the initial investment needed. The debt ratio aids in determining a company’s capacity to service its long-term debt commitments. As discussed earlier, a lower debt ratio signifies that the business is more financially solid and lowers the chance of insolvency. With this information, investors can leverage historical data to make more informed investment decisions on where they think the company’s financial health may go.

Translations of debtor

As a result, drawing conclusions purely based on historical debt ratios without taking into account future predictions may mislead analysts. The debt ratio doesn’t reveal the type of debt or how much it will cost. The periods and interest rates of various debts may differ, which can have a substantial effect on a company’s financial stability. https://turbo-tax.org/ In addition, the debt ratio depends on accounting information which may construe or manipulate account balances as required for external reports. So if a company has total assets of $100 million and total debt of $30 million, its debt ratio is 0.3 or 30%. Is this company in a better financial situation than one with a debt ratio of 40%?

For example, the United States Department of Agriculture keeps a close eye on how the relationship between farmland assets, debt, and equity change over time. A ratio greater than 1 shows that a considerable amount of a company’s assets are funded by debt, which means the company has more liabilities than assets. A high ratio indicates that a company may be at risk of default on its loans if interest rates suddenly rise. A ratio below 1 means that a greater portion of a company’s assets is funded by equity. The debt-to-equity (D/E) ratio is a leverage ratio, which shows how much of a company’s financing or capital structure is made up of debt versus issuing shares of equity. Recording creditors (also known as payables) in your bookkeeping will help your business keep track of how much money is owed against any income.

Understanding Accountancy Terms: Debtors and Creditors

Legally, someone who files a voluntary petition to declare bankruptcy is also considered a debtor. However, it is required to seek court approval for any actions that fall outside the scope of regular business activities. The DIP must also keep precise financial records, insure any property, and file appropriate tax returns. In fact, banks and financial institutions are the most prominent creditors in today’s economy. As these entities loan businesses money to finance their ventures – be it expansion, or otherwise – they become creditors. They become creditors as those businesses are required to repay to money borrowed.

The set of laws governing debt practices activities, known as the Fair Debt Collection Practices Act (FDCPA), forbids bill collectors from threatening debtors with jail time. However, the courts can send debtors to jail for unpaid taxes or child support. Creditors – In day-to-day business, a person or a legal body to whom money is owed is known as a creditor. For a business, the amount to be paid may arise due to repayment of a loan, goods purchased on credit, etc. While purchasing goods on credit a buyer may not make the payment immediately instead both the seller and buyer may enter into a lending & borrowing arrangement.